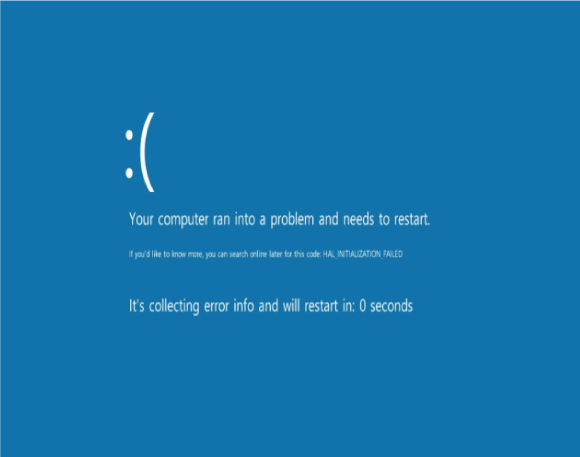

Reboot

After anemic growth in the economy during the past few years, it looks like it may be weakening further according to data released on March 25th. The economic figures showed a drop in business spending and investment. Further, orders for durable goods such as computers, washing machines and lawn mowers dropped 1.4% in February from a month earlier. Not unnoticed in this data, is that the weather may have played a big role in the weakness. We agree with that fact, but we view this slowdown as an inevitability. With interest rates at historic lows for quite some time, the economy has yet to regain the vigor it had prior to the 2008 crisis.

In the weeks ahead, we will be getting corporate reports on first quarter earnings.

The forecasts are not good. The consensus estimates for the S&P are for earnings to be down 3.3% versus last year’s first quarter. Both rising labor costs and the dollar’s strength create profit headwinds, particularly for companies with international exposure.

Congress and the President have not been able to pass legislation providing incentives for investment. Higher taxes have come at a bad time for most, as the asset recovery has just started to make people feel more comfortable. Democrats will be unhappy about these sentiments as we move toward the national elections. Republicans will point to the President’s inability to lead and take political advantage of the recent slowdown.

As an investor, in light of the current political backdrop, one should stay focused on holding shares of companies with strong cash flow, bonds with solid credit, and hedge funds that can take advantage of potential distress and volatility.

In the real estate arena, generally speaking, multifamily housing still looks interesting—commercial less so, as returns keep coming down in most major metropolitan markets. Biotech and healthcare sectors have been on fire despite a recent blip. We believe these areas will continue to have a better trajectory than most other investments. The changing world brings great technology companies to one’s attention. Some old favorites are morphing into dynamic providers of disruptive technology, and those will do well also.

Warren Buffet concluded another mega deal with Heinz and Kraft. Mac and Cheese really cannot be beat!! Consolidations are at hand… Kraft and Heinz, United Health and Catamaran and Dow Chemical’s chlorine business with Olin. We expect this trend to continue as companies strive for “BIG” to offset an environment which makes top line numbers more difficult to achieve.

The Federal Reserve has indicated a desire to raise interest rates, but truly has shown no willingness to “mess” with the fragile recovery. In essence, with the absence of good pro-investment, pro-business legislation, the Fed has had to save the day with zero/low interest rate policies. We conjecture that the central bank may raise rates in June beginning with increments of 10 basis points (a basis point is one hundredth of a percent). This would be unprecedented, yet nevertheless, may kill two birds with one stone. This action would give the right signal to the markets while keeping the pace of increases at a very digestible rate.

It is time for the President and Congress to reboot our economy through incentives to business as well as to individuals. The Federal Reserve can no longer do this alone. We believe volatility will continue and view the balance of the year to be extremely challenging.

We believe that our clients are well positioned for the rough seas ahead. In part, this is due to our unique ability to access the best investment products from multiple sources. As the pillow in my office reads, “Don’t confuse brains with a bull market”.

We thank our clients for their continued confidence and invite you, as friends, to hear more about our unique organization as the year unfolds.

Careful Crossing,

With Kindest Wishes Always,

Seymour W. Zises